The tide is finally turning for South Africa

While reflecting on the developments since the ANC conference in December, Lenin’s quote springs to mind, “there are decades where nothing happens,and there are weeks where decades happen”.

Since the conference in December, Cyril Ramaphosa has made admirable progress by preventing Eskom from defaulting with a decisive restructuring of its board, making clear his intent to fix the criminal prosecution system and fight corruption, charming foreign investors at Davos, and finally, to the relief of many, forcing Zuma to resign. The boost to both business and investor confidence is palatable and is set to give the South African economy a much needed stimulus after the nine dark years in Zuma’s shadow.

In line with this, the tone of the speech delivered by Finance Minister Gigaba on the 21st of February was very different to his Medium Term Budget speech delivered in October 2017, which resulted in a massive bond and rand selloff, as the fiscal risks were shown to have increased significantly.

The tone of this budget speech reflected many of the themes raised in Cyril Ramaphosa’s SONA speech, such as those pertaining to renewal and integrity. The budget was clearly focused on restoring investor confidence by coming back to the path of fiscal consolidation and stabilisation of the escalating debt levels. Some difficult decisions were taken, like increasing VAT for the first time in 23 years, and reducing the expenditure ceiling amongst other expenditure measures. Rating agencies should see these trends in favourable light and the Moody’s downgrade is most likely on hold for now – starving off potentially large capital outflows. Fitch and Standard & Poor’s could also change their outlook on our debt rating from negative to stable in March. These are all positive developments for the rand and bond outlook.

Bonds and the rand have now rallied compared to October 2017

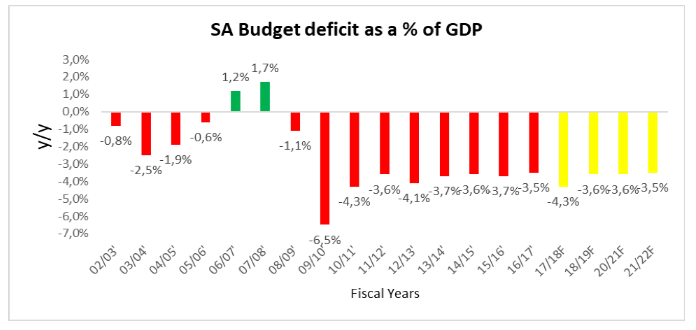

The 4.3% budget deficit of the Medium Term budget in October 2017 has been pulled back to 3.6% for the 2018/19 fiscal year, through revenue collections being boosted by the VAT hike, less fiscal drag accommodation than previous years, a 52c/L fuel levy, and the normal increase in taxes. At the same time, the expenditure ceiling has been lowered by R85bn. The projected deficit over the medium term will be less than 4%. We have already seen a positive reaction in the bond market to the lower deficit projections and, hence, lower future bond issuances with yields falling to below 8%.

Budget deficit as a percentage of GDP to stay below 4%

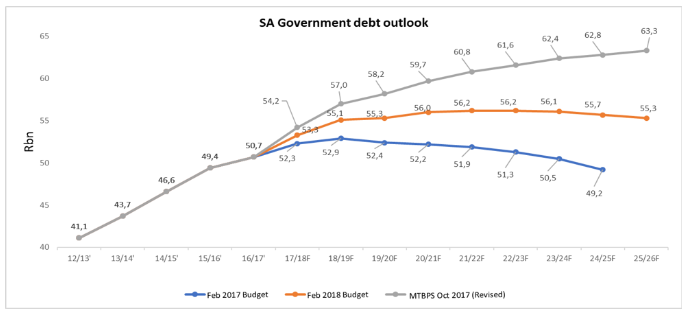

The debt to GDP is now projected to stabilise to around 56% by 2020 and then decline, as opposed to escalating to above 60%. These are all positive trends for the rating agencies and the outlook for the South African economy.

Government debt to GDP outlook has stabilised

For individuals, the scare stories around wealth tax did not materialise as the fiscus acknowledged that the tax burden on a small tax base has increased substantially over the last few years and any further increases on this tax base could be counterproductive. This means that no wealth tax was introduced and there were no changes to dividend tax, capital gains tax, the top marginal tax rate, or company tax. There was, however, an increase in estate duty from 20% to 25% for estates over R30 million.

The biggest tax adjustment was the increase in VAT from 14% to 15%. This is the first increase in 23 years and brings us in line with other emerging markets. This increase, together with the fuel levy, will impact consumer disposable income. However, with less political risk, and the firmer rand and inflation rate within the target range, there is now an increased chance of a 0.5% rate cut at the next MPC meeting. In addition, given the stronger rand and the lower oil price, the fuel levy increase could well be offset by a cut in the petrol price soon. Overall, the inflation rate, which is at 4.4%, could increase marginally on the back of the VAT hike, but not enough to push it out of the Reserve Bank’s inflation target range of 3-6%.

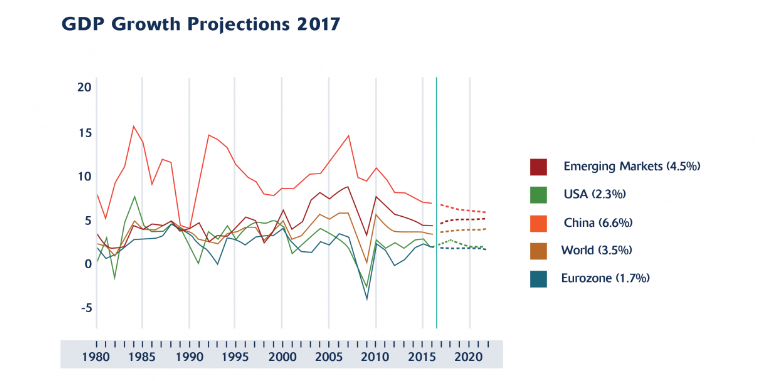

Overall, the budget has starved off potentially negative developments, such as a Moody’s debt downgrade, and will improve investor confidence. This, together with the progress made by Cyril Ramaphosa on various fronts, is set to boost the South African economy onto a better trajectory than this time last year. The year ahead is not without challenges for Cyril Ramaphosa, but with the right cabinet in place, less pressure from rating agencies, a positive global environment, and a local economy on a much better footing, these challenges will be more manageable.

In terms of portfolio positioning: In early February, we added to our bond exposure at higher yields and reduced our offshore holdings from 25% to 20% to reduce the impact of a potential rally in the rand. This has worked well and, at this stage, we will maintain our present exposures, as a lot of good news is now priced in. The rand and bond yields are likely to stabilise around present levels as some profit taking occurs and as the market watches for the implementation of the budget. The rand has now rallied by 20% since October 2017 and this is not likely to be repeated over the short term unless a major event occurs. As such, we will maintain our 20% direct global equity exposure as this should continue to deliver attractive rand returns given the still favourable global environment. Going forward, the application of the measures announced in the budget will be crucial and the composition of the new cabinet will be the next big step in turning the tide for South Africa.