A challenging budget delivers tighter belts.

All eyes were on Finance Minister Pravin Gordhan in February as he delivered the 2017/18 budget. We were warned that it would be tough, and he kept to that. With weak economic growth and the rating agencies still keeping us under the spotlight, Gordhan had little room to move.

His main challenge was to keep the budget deficit under control. He managed to limit the deficit to 3.4% of GDP for 2017/18 by maintaining the expenditure ceiling target and closing the R28bn tax revenue gap.

https://www.youtube.com/watch?v=D7jpqwjJ0fE

The main tax adjustments made in this regard were:

1. A sharp rise in the top marginal tax rate from 41% to 45% on incomes over R1.5 million a year. This will impact about 103 353 registered taxpayers. Although this group only forms 1.4% of the registered tax base, they will be contributing 26.3% of the individual tax burden in 2017/18. In essence, an additional R126.9bn will be sourced from the so-called ‘super rich’.

2. The middle classes were not unaffected, however, as there is little provision for fiscal drag. In fact, the tax burden for middle income earners will increase too with R16.5 billion in additional tax revenue coming from this source.

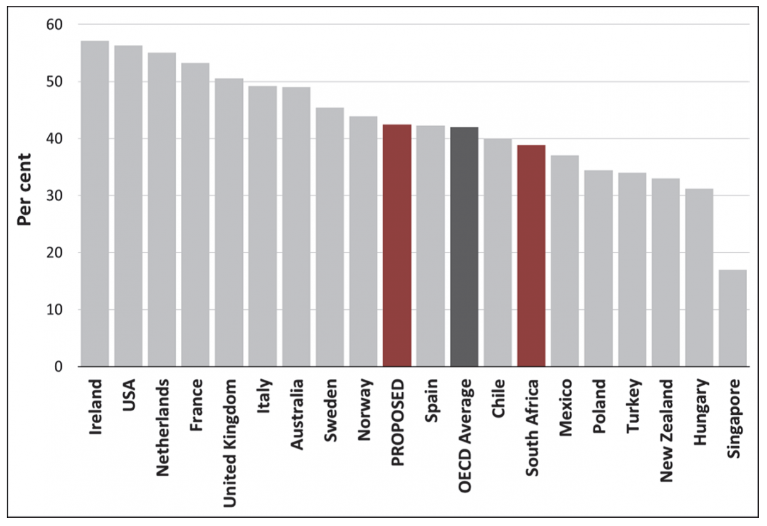

3. The withholding dividend tax was increased from 15% to 20%. This has been done in order to reduce the difference between the combined statutory tax rate on dividends of 38.8% and the new top marginal personal income tax rate of 45%, effective as of 22 February 2017. Importantly, this won't just impact the wealthy but also beneficiaries of retirement funds which, on average, hold around 60% in equities. This is estimated to raise R6.8 billion in additional tax revenue. Currently South Africa's combined statutory tax rate on dividend income falls below the Organisation for Economic Cooperation and Development (OECD) average.

Statutory tax rate on dividend income

4. In line with previous budgets, the fuel levy was increased by 30c/L while the Road Accident Fund got an additional 9c/L. This amounts to a total petrol price increase of 41c/L effective as of the 1st of March. This has an impact on the inflation outlook and could well slow the speed at which inflation declines as increased transport costs are passed onto the consumer. In addition, the zero VAT rate of fuel will be lifted in the 2018/2019 tax year.

5. For the “sinners”, the usual hikes in excise duties were made on alcohol and tobacco which would yield a further R1.3 billion in revenue.

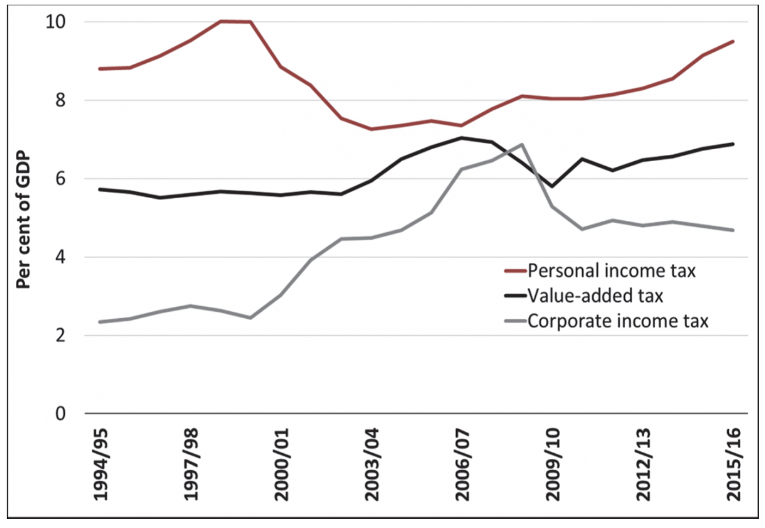

6. VAT remains at 14% but, if economic growth doesn’t improve and there are further revenue shortfalls, this will have to be raised. In comparison to other emerging countries our VAT could well be raised as other emerging market economies have VAT rates, on average, at around 15%. VAT is an indispensable component of revenue (25.2%) and significantly exceeds corporate tax receipts.

7. Forunately the corporate tax rate remained the same and, in fact, collections were on track from this source.

Main sources of revenue

In total, revenue will increase by 9% to R1.14 trillion for this fiscal year, with every single taxpayer paying the price of South Africa's slow growth and inefficient government expenditure.

On the expenditure side

The Minister is projecting average expenditure of 7.9% per year. This is slightly above inflation and suggests government is trying to be more disciplined despite the pressure it is under.

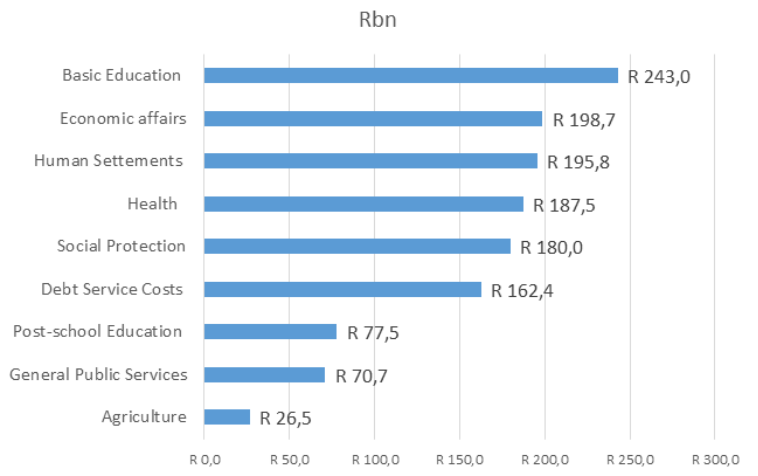

The key growth areas remain education, healthcare and welfare (social grants). Under pressure from last year’s unrest at universities, the government has allocated R105 billion on transfer to universities and R54.3 billion to the National Student Financial Aid Scheme (NSFAS).

Government Expenditure in Rbn

The Minister has planned increases of 8% on healthcare as they have indicated that government is ready to move into the next phase of the National Health Insurance (NHI). They are considering reductions in tax credits to medical schemes to fund the expansion of the NHI.

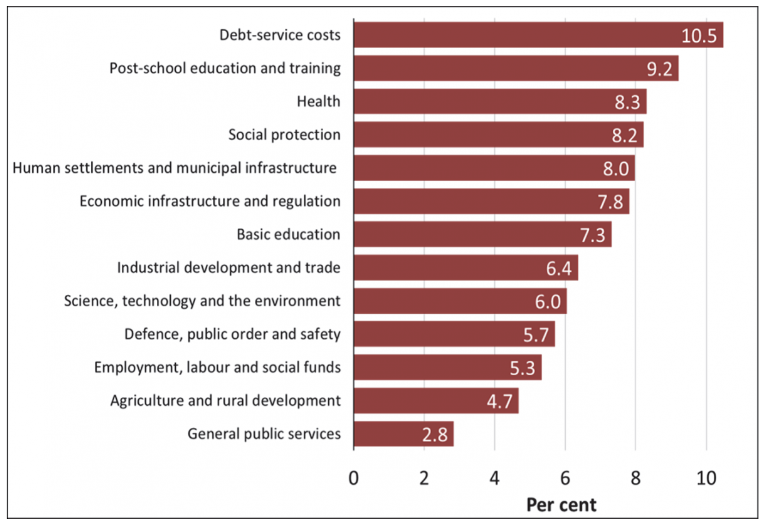

The most concerning item is the debt servicing costs rising by 10%. This is now 11% of total expenditure and the fastest growing item. If we get a debt downgrade, the cost of this debt will rise even further. For now, our debt as a percentage of GDP of 50% is acceptable by world standards, but it is expected to rise to 52.3% in 2017/18 - far higher than the 26% average acheived in 2009. If this rises further it could become a major hindrance to many policy changes as more and mroe money is allocated to the servicing of debt.

Budgeted increases for various expenditure items

In Summation

The 2017 budget was presented under very difficult economic and political circumstances. The ratings agencies will welcome Gordhan’s intention to reduce the budget deficit and to contain government debt but will be disappointed by continuing poor economic growth, the underperforming revenue numbers and very little progress having been made on State Owned Enterprises (SOE’s) like SAA , Eskom and the like.

Households will remain under pressure given the rising tax burden while investors will be disappointed by the increase in dividend tax. Little was in the budget to boost business confidence in a tough environment. On the plus side, the Minister has managed to do enough to most likely maintain our credit rating and has managed to maintain fiscal discipline with the budget deficit projected to decrease to -2.6% of GDP by 2019/20.

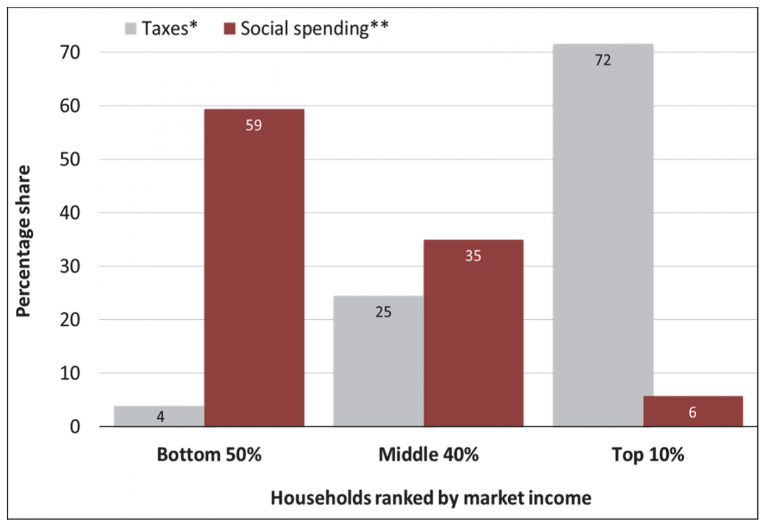

The budget remains extremely redistributive, in line with government policy, but it will come to point where the tax burden on a few will become too great and counterproductive

A highly distributive budget - tax burden vs. social grants beneficiaries

The bottom line is that we need stronger economic growth - far more than the 0.2% of last year - in order to ensure that the right budget of 2017/18 is not repeated. As global growth improves, commodity prices pick up and growth in tourism and the financial sector firm, growth in 2017 is expected to improve to around 1%. This is still not enough, however, and although better, the economic environment will remain challenging in setting next year’s budget.