Quantifying the value of financial advice

You may have wondered whether hiring a financial advisor is worth it. After all, they charge you money to make you money, which seems counterintuitive. You may even have heard others say that you are better off keeping that fee for yourself and investing your money according to what you have heard and read in the news.

The truth is, however, that good financial planning extends beyond where and how you invest, and, according to several sources, so does good financial advice. Simply put, financial advisors make decisions about money to help clients meet certain goals and aspirations over their lifetime, where planning is a continuing process of anticipating and adapting to changes in personal circumstances over the long term. But, financial planning advice is more complex than this and, as the financial advice industry continues to gravitate towards fee-based advice, as opposed to commission based, there is great temptation to define an advisor’s value-add as an annualised number. After all, their value and impact on their client’s wealth creation is very real indeed.

Can the value of financial advice be quantified?

For advisors who promise better returns, the question is: better returns than what? Better returns than those of a benchmark or “the market”? Better returns than those provided by an investor who does not use an advisor? Looking at these questions, it is understandable that advisors, and investors, would want a less abstract or less subjective basis for their value proposition. The Vanguard Alpha Framework, developed in 2001, outlines how advisors can add value, or alpha, through relationship-orientated services. The term ‘alpha’ identifies how a fund manager can combine securities into a portfolio that will result in, hopefully, earning more money than expected. This is generally achieved either through correctly timing market trends or picking winning individual securities.

According to Vanguard, advisors can potentially add “about 3%” in net returns by using the Vanguard Advisor’s Alpha framework. This 3% is primarily driven by two core factors. The first is developing and helping the client stick to a plan. This entails structuring a plan around the financial goals and level of risk that the client is comfortable with. The second is ensuring that the client's products and fund selections are correct. Most people think that the benefit of an advisor lies in their investment recommendations, but recommendations on product choice, especially those with tax implications, also have an enormous influence on a client’s final outcome.

Does financial advice make a difference?

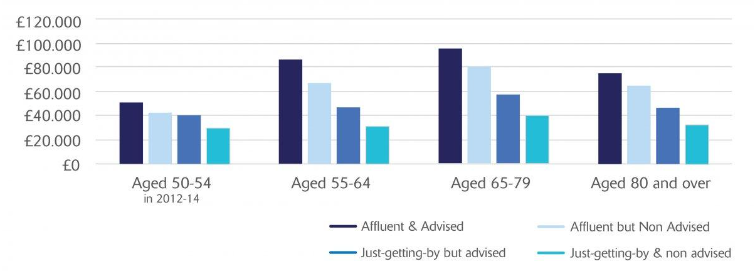

Theoretical frameworks aside, a study by the International Longevity Centre (ILC) in the United Kingdom sought to explore whether advice makes a difference in terms of saving more, investing more in equity assets and, ultimately, more retirement income. The results strongly demonstrate the positive value of financial advice for consumers – both amongst those who are wealthy and those who are less wealthy. The study found that those who took advice were significantly more likely to save more as well as to invest in the equity market. The “affluent but advised” group was 6.7% more likely to save and 9.7% more likely to invest in the equity market than the equivalent non-advised group. The “just getting by group” was 9.7% more likely to save and 10.8% more likely to invest in the equity market than the equivalent non-advised group. As a result, they ended up with more financial assets (£13,435) and pension wealth (£27,664) by 2012-14 than similar individuals who did not take advice.

Interaction between financial advice and age when predicting financial wealth accumulation

Source: authors’ estimates from the Wealth and Asset Survey (2006-08, 2012-14); estimates show predicted financial asset for treated and control groups by age category.

So, is all financial advice good advice?

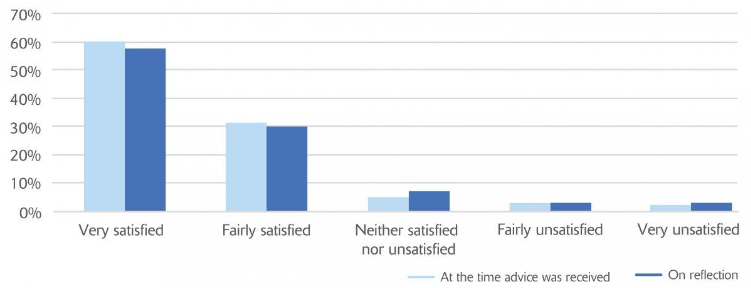

Does this mean that there is real value in financial advice? Yes. But, like many other services, financial advice is only as good as the advice and relationship itself. For many clients, entrusting their future to an advisor is not only a financial commitment but also an emotional commitment much like finding a new doctor. As the study by ILC found, the experience of taking advice is highly satisfactory as 9 in 10 people were satisfied with the advice received, with the vast majority deciding to go with their advisor's recommendations.

Client satisfaction with financial advice

Source: authors’ estimates from the Wealth and Asset Survey (2012/14) data are weighted using cross section weights.

So yes, a financial plan promotes more complete disclosure about clients’ investments, but more importantly, it provides a perfect way for clients to share with their advisor what is of most concern to them: their goals, feelings about risk, their family, and charitable interests. All of these topics are emotionally based and a client’s willingness to share this information is crucial in building trust and deepening the relationship. With this in their arsenal, a financial advisor can go beyond just selecting investments and can add real value to their clients’ lives.