Abby Joseph Cohen at the CFA Conference

Following a fast-paced, enlightening and fulfilling three days, my experience came to a close with a detailed and in-depth analysis of the global macro-environment – with a particular focus on the USA - by Abby Joseph Cohen.

Cohen is the Advisory Director and Senior Investment Strategist at Goldman Sachs. She recently retired from her leadership of its Global Markets Institute and, until 2008, was their Chief Investment Strategist. She is most famous for predicting the bull market and tech boom of the 1990’s early in the decade, earning her the Institutional Investor’s accolade of top strategist 1998-1999.

One of few women speakers at the CFA conference, and in the industry at large, Cohen is an esteemed thinker and industry leader. So much so in fact that her career is the subject of a Harvard Business School case study. The holder of numerous honorary doctorates from around the world, as well as countless awards, Cohen has most notably been the recipient of accolades from the Financial Woman’s Association and the New York Stock Exchange.

She has a real knack for analysing and anticipating some of the most important macro-economic themes to watch when it comes to investing in our ever-changing environment.With her focus understandably skewed toward the USA, she highlighted some important trends and information that will be informing our investment approach in the coming months. Below are some of the key take-outs that we've gained from her presentation.

US Economic Overview

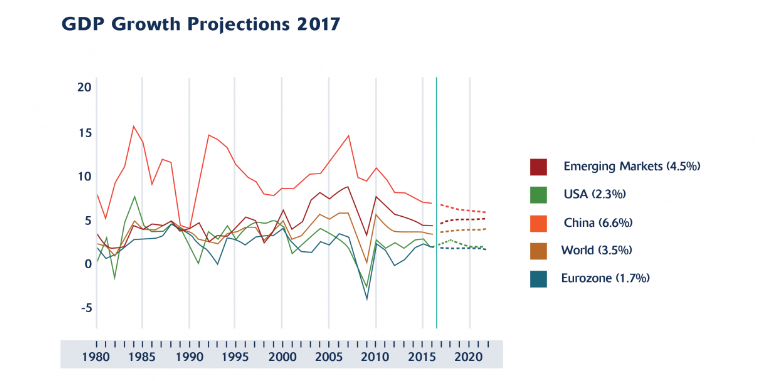

She began her presentation with an overview of the current US economic conditions. The core points she noted in this regard were that, utilising the 2017 average thus far, there is projected GDP growth of 2%. That said, however, Goldman is assuming 3% growth for the year and have made their investment decisions accordingly. This is in contrast to the Eurozone which is projected to see 1.7% growth this year, with China decelerating projected to reach 6.8%. Global growth remains on track with global GDP projected at 3.5% for 2017 with the emerging markets projected to reach around 4.5%.

The second area of significance that she noted was that there has been wide variation by sector in this regard. She paid particular attention to highlighting the growth of US exports over the last decade which are up a notable 60% since 2007. The tech industry has also been steadily growing, though at a slower pace, while a core reason for concern – and out of keeping with his elections promises – has been a continuation of the slowdown in government spending under Trump.

Exports and Trade

Cohen credits the significant increase in US export growth as that which enabled the USA to be the first nation to emerge from the financial crisis. Interestingly, this strength in US exports has persisted despite the ongoing strengthening of the Dollar since mid-2011 which she puts down to worries and political instability over the Eurozone, China and Latin America.

Another topic of discussion was the US’ current trade deficits with China, Mexico and Europe. America has had the largest trade deficit in the world since 1975, which has long been a drag on GDP. The Trump administration has made ‘slashing’ the trade deficit one of its core policy objectives, particularly that with nemeses of choice China and Mexico.

The US trade deficit with China currently sits at $347 billion. In fact more than 40% of the US’ entire trade deficit in goods was with China, predominantly in consumer electronics, clothing and machinery. The vast majority of US ‘Chinese’ imports are from US companies sending raw materials there for low-cost assembly. Despite Trump’s claims that China is artificially undervaluing its currency by 15-40% on average, Cohen points out that while this may have been true in 2000 it is certainly not true anymore and imposing higher tariffs on Chinese imports could in fact do more harm to the US economy than good. The best way to resolve the Chinese trade deficit would in fact be to better absorb the foreign savings flooding into US markets, for example by investing in much needed infrastructure.

The trade deficit with Mexico is a far more moderate $63 billion, though it is the highest it has been since 2007. Mexico is also the US’ third largest trading partner with $525 billion in annual trade between the two neighbours, and much of the same concerns regarding foreign savings inflow and their effect on any sanctions and tariffs imposed.

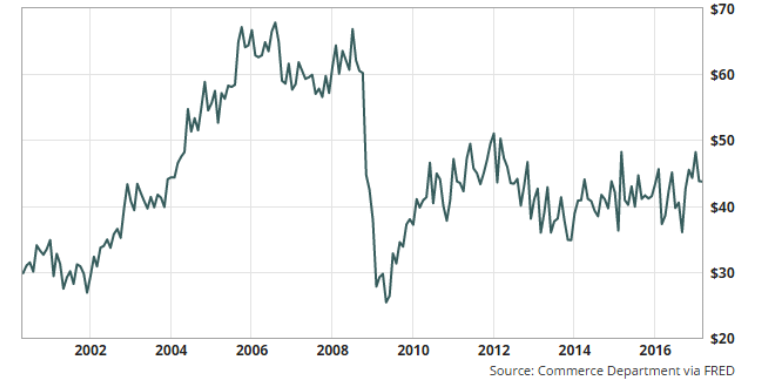

Despite the heightened attention placed on trade deficits by the Trump administration Cohen notes that the current deficit sits at 3% of the total US GDP which is a notable improvement from 10% during the financial crisis. It is, however, expected to rise to 5% due to medical care.

Trade Deficit

In billions, seasonally adjusted

Business Investment in Equipment

Another core factor influencing US GDP, as Cohen notes, is business investment in equipment and software. In fact, after exports, Cohen attributes the second biggest contributor to the US coming out of the recession as spend in business equipment.

She believes that residential fixed investment and business fixed investment is set to rise in 2017, and has been largely rising since 2010, while public non-residential spend has been lacklustre for the last 7 years.

While there has been a building and housing boom of late in the US, boding well for the US GDP, Cohen notes that government underinvestment in infrastructure is negatively impacting this. So is the reduction in investment in office space and technologies due to increasing reliance on telecommuting in the USA. In fact there has been a 24% decline in office space since 2009. Companies have gone for cash savings preferring to pay out dividends to their investors (boosting stock prices) and conduct largescale share buybacks rather than investing in capacity for further growth.

Government Spending

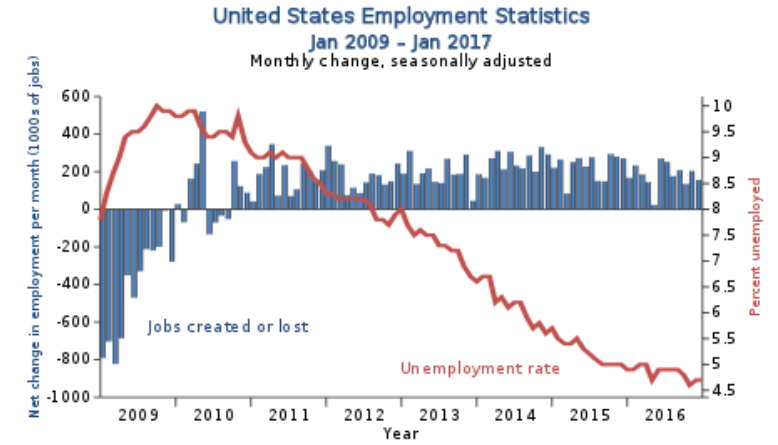

Consumer spending makes up 65-70% of US GDP and has increased significantly in recent years boding well for the US economy with consumer balance sheets looking good. This is in large part due to accelerating expansion employment, leading to an increase in household’s purchasing power, with unemployment in the USA at 4.4%.

Cohen says, however, that reduced government spending is still causing a drag on overall GDP and employment despite the early advances made with the US taking only 6 years to return to pre-crisis employment levels. That job creation has largely been led by the US’ major cities, the need for infrastructure investment to make further advances in employment is apparent.

STEM Industries

The STEM industries – Science, Technology, Engineering and Maths – have flourished in recent years, particularly since the financial crisis with Cohen noting that STEM related industries earn more than double the norm. This is despite the fact that STEM makes up only 7.2% of private employment.

Interestingly, employees in STEM industries, particularly those with Bachelor’s degrees or higher, were the least affected by the recession in terms of job and income loss holding the highest median income per household with the fastest growth and least fluctuation since 2000.

In Conclusion

When asked for her position on the current US stock market Cohen comments that equity prices are high, however she believes that valuations represent fair value in the USA and therefore are not overvalued as many others at the CFA have indicated. She notes the low levels of volatility in this regard but did concede that, despite her position, she worries when everyone is happy.

She does believe fixed interest bonds are currently overvalued saying that government bonds are unattractive investments with their yields negative for more than half of the developed world.