Trade Winds – Notes from the skipper’s desk on the journey ahead.

London, May 2019, Chartered Financial Analysts Investment Conference feedback – Entitled disruption.

With our view to staying internationally relevant and up to date on current global investment opportunities and trends, the investment team attended the Annual Chartered Financial Analysts investment conference in London in May. We spent the day before the conference with Investec Asset Management and the day after with Prudential U.K.

To balance the world of finance and investment, I was fortunate to have the opportunity to attend both an awesome Eric Clapton concert at the Royal Albert Hall and an equally inspiring Van Gogh art exhibition at the Tate Britain gallery. Grand Masters all round! An inspiring week was had by all in the world’s pre-eminent financial capital. The mission remains the same – keep calm, focus on the long term, be patient and stay diversified!

A day with Investec Asset Management UK - Sustainability is a key theme.

Hendrik Du Toit, the CEO of Investec Asset Management in London, had a very sage opening message for us all. He was happy with the election result back home; Cyril Ramaphosa, in his opinion, had five years to turn things around. If he stopped the corruption, our GDP would move up 3.5%. The ANC simply needed to choose which economic policy they were on!

On sustainability, a key theme, Du Toit also brought to our attention to the fact that the United Kingdom had their first coal-free day, where the power grid was powered without coal. Quite a thought considering we in South Africa are struggling to turn our new Eskom coal-powered stations on!

Sustainability was a central issue at the investment conference and with the general public in the U.K. and Europe. Sustainability is seen as a key driver of change, and business and investors need to pay close attention. “De-carbonisation was the next internet,” Du Toit stated. He was quick to point that out.

Where there is change, there is opportunity! We checked our resource stock exposure in the funds for both our coal holdings and our exposure to lithium, the resource that batteries use, as resources drove the fund’s growth over the last year.

Insights from the Chinese Minister of the Embassy of the People’s Republic of China in the U.K., Ma Hui - A head wind

We were honoured to have Mr Ma Hui address us at the Investec day. He gave the official Chinese reasons for the miracle that saw an epic eight hundred million people move out of poverty over the last forty years. Their Communist party U.S. dollar reserves moved from an incredible 70 000$ to over 2T USD.

He stated, “firstly, China was committed to its own path. Secondly, China practised socialism with Chinese characteristics – i.e., meet the peoples’ needs for a better life first. (Sub-narrative - We build bridges and infrastructure rather than fight other peoples’ wars) Thirdly, China is committed to embracing the world.

It should be noted that China has used this opportunity with the support of the government to build “national champions” that have come to dominate western markets in some fields, while not allowing western companies the same access to their markets – much to Trump’s and the Republicans’ ire and hence, their current tariff and trade war focus.

In his conclusion, the Minister said that the West needed to see the world from the Chinese perspective and not a Western perspective. This reaffirmed our view that the Chinese do not generally respect Western rules and liberal democracy; they play by their own rules. And of course, little recognition was given to the fact that without Chinese access to Western markets, there would not have been a miracle at all.

Implications - Initially, analysts speculated that Trump would resolve the trade issue before the next U.S. election; it’s now thought that this trade war could drag on for some time. They are prompting a U.S. Federal Reserve response.

US Monetary Policy Response – Preparing for the long haul. Following wind.

Prompting the Federal Reserve Bank of the U.S. to put the interest rate hike cycle on hold and even consider interest rate cuts is a significant policy U-turn, to provide liquidity in the financial markets to support and encourage the upward equity market movement.

Navigation Hazards

Conference Insight - Most frequently asked question by investors offshore

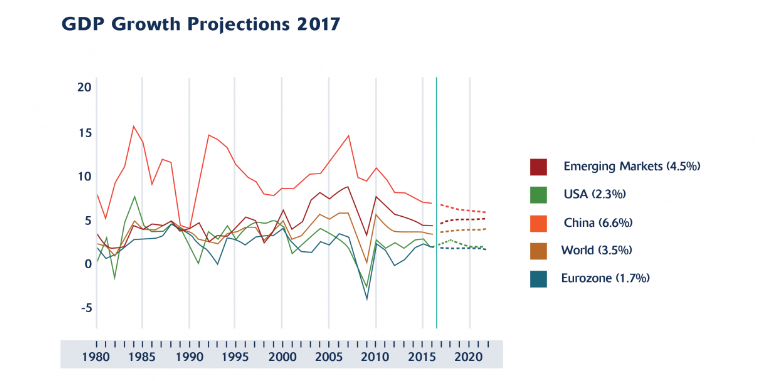

Jeraldine Sundstrom from PIMCO reported that the most frequently asked question by investors was, “When is the recession going to come?” The answer: There is no big recession at all, and in fact, there is very little recession at all! U.S. Monetary policy is dovish and supports the equity market; there is no oil shortage, no inflation, no overinvestment, and no overconsumption. However, there is one uncertainty, and that is the increasing trade war between China and the USA and the impact of the trade war on economic growth.

Investment Response - Managing Investment Risk - Batten down the hatches

The feeling was that there wasn’t a recession around the corner and in fact, we are in the late part of the cycle rather than at the end of the cycle. At this stage of the cycle, it’s all about managing risk, moving to quality low PE stocks with solid cash flow, considered to be value stocks rather than growth stocks. We are conservatively positioned in all our funds, with tactical overweight positions in cash, which we will hold until such time as opportunities present themselves.

From an individual investor’s perspective, it’s important that investors make sure that they are in the right risk profile fund during this period of change.

While back home in South Africa – A favorable wind shift

Some years ago, when we were going through a challenging period, a client of mine who is a Doctor of Economics employed by the World Bank gave me some very useful and calming advice when I complained despondently about our poor economic and political position. He said, “Mark, are we better or worse than what we were three years ago?” Invariably, I would respond that we were actually better off, much better off.

In a similar way, having Cyril Ramphosa at the helm today rather than Zuma puts us in a much better position than what we were, we are at least heading in the right direction. It’s still a difficult journey ahead.

Investment Response – Hold your course

The most frequently asked question in the last quarter was, “Should I invest offshore? Is the rand going to get weaker?” Usually, asked with reference to a well-known advisor/journalist’s articles from Johannesburg who describes the South African situation as being hopeless, dire and on an ever downward spiral.

The rand – Take the long- term view and avoid short-term speculation.

Our answer is and remains as follows: over time, the rand will depreciate for as long as our inflation exceeds our trading partners’ inflation rate, by at least that much. There are times when the appreciation looks positive, but over the long term, the rand’s value will fall. Avoid short term speculation.

Offshore diversification investment rationale – Access more opportunities

The second part of the answer is possibly a little easier to understand. It’s simply a question of increased diversification: investing in South Africa is fairly limited. For example, we only have access to one major tech company, and that’s Tencent held via Naspers. If you diversify your investments, invest offshore and simply buy the S&P500 index fund, you have access to all the majors, Facebook, Apple, Netflix, and Google, now Alphabet. We have exposure to the S&P500 in our funds. We have about 24% directly held offshore exposure and a further 36% indirectly offshore, making up about 60% of the portfolio.

Opportunities back home – Buy South African coastal property

Given the S.A. despondency, recent political election rhetoric and general low confidence, now would be the time to buy S.A. property, particularly coastal property, before the confidence cycle turns, which it inevitably will. In rand terms, S.A. property is still very cheap and good property has proven to hold its value in dollar terms over time.