When, how and why to look offshore?

A common refrain in local investment commentary, re-surfacing annually, is: “Is now the right time for South African investors to go offshore?” A few times a year, every year, there are investment strategists who rise to the fore saying that “The right time is now”.

Most often the key evidence used when asserting these claims is Rand volatility and performance. The question thus becomes one of ‘whether or not the Rand will continue to appreciate’? What many investors, and some investment strategists, fail to realise though is that this is not how we should be determining these decisions at all.

When we take a long view of Rand performance, the kind of perspective we need when making the medium- to long-term investment decisions which enable capital preservation and growth, we see that the Rand has been steadily depreciating.

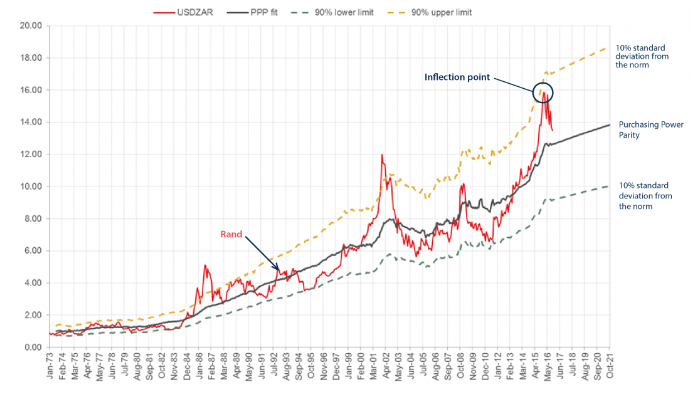

While month to month and year to year it is easy to assume that local political and social events drive the value of our currency, in reality these events are more accurately identified as political, statistical ‘noise’. The recent political uncertainty, leadership issues and debt downgrade concerns that have come to dominate the headlines and economic commentary in our country have much less of an influence on the value of the Rand, and our money in world markets, than the attention that they garner would lead us to believe. Serious appreciation and depreciation of the Rand since the 1980’s follows a typical regression to the mean and ‘normalisation’ as uncertainty, volatility and market knee-jerk reactions subside. Take a look at the graph below to get a clearer view.

SA Rand - Will the Rand Continue to Appreciate?

The Rand, in red, has been somewhat consistent with the line of Purchasing Power Parity (PPP) since 1973. PPP is a good leading indicator of where the Rand ‘should’ be as it is a commonly used reflection of the intrinsic value of the currency. The Rand has only dramatically deviated from this norm six times in the last 44 years. What we can see from this graph is the steady depreciation of the Rand over time. These marked deviations are, as always, the market’s response to political noise. The overall depreciation of our currency, however, has been notably consistent.

In reality, if we really want to understand and grapple with the performance of our currency over time – and indeed most currencies - we need to be analysing the performance of the Dollar, not the Rand. Aside from these rare deviations from the norm, the recent ‘appreciation of the Rand’ which is heralded as the defining metric to consider in the onshore/offshore debate is really Dollar weakness.

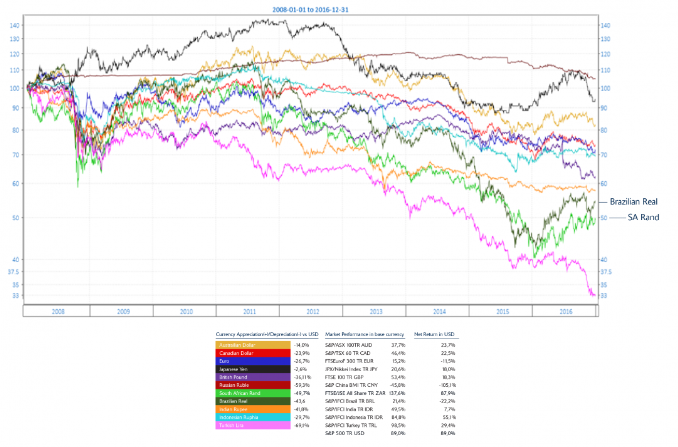

This becomes clearer when we track the performance of other currencies relative to the Rand and Dollar oscillations, as in the graph below. When we take such a broader perspective we see that global currencies from the Rand to the Brazilian Real, the Australian Dollar to the Indian Rupee have all endured these same fluctuations along a similar trajectory, moving together against the US Dollar since 2008. It thus becomes even clearer and more urgent that we understand the ‘strength’ of our currency as Dollar weakness, and the ‘weakness’ of our Rand, in large, part as Dollar strength.

Global occurrences against the dollar

When to go offshore

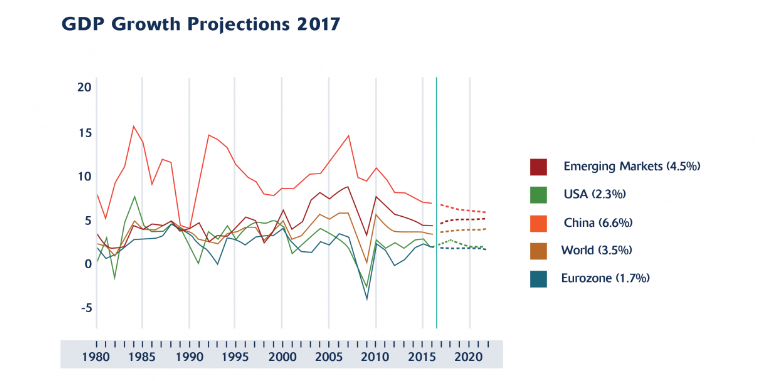

And thus, to the perpetual question, “Is now the right time”? The US Dollar will continue its regression to the mean weakening as it does so. There are four key points to consider in this regard, only one of which affects the Rand. The Dollar’s continued depreciation is in large part due to the fact that the Dollar has fully priced in interest rate differentials, which have already happened. Further, commodities prices and emerging markets will continue to improve on their upward trajectory as the Dollar weakens further and investors look to find returns in emerging economies. As for the Rand, our currency may strengthen further as the potential downgrade risk, already priced in, alleviates.

And so, what to do? If you are a long-term investor, the timing of the decision to go offshore should not be of major concern. Fundamentally, over the long term, the Rand is expected to continue to depreciate due to unchanged fundamentals and structural decline. The deficit in the current account is similar to a year ago, the fiscal position is relatively unchanged, growth is slowing further and Zuma looks set to complete his term in office.

When investing for the long-term, small ‘wins’ or ‘losses’ when taking your money offshore will be countered by the long-term growth of a sound investment decision. If long-term offshore investment is your objective, then the question shouldn’t be ‘when’ but where and how.

Should you wish to trade the Rand, however, then there may be an opportunity to benefit from an appreciating Rand in the near-term. The risk to such a trading mentality is that leadership concerns in South Africa persist and ‘shock’ events like we saw last year may occur again and most often without warning. Ultimately, for those wishing to trade currency, it comes down to your tolerance for risk. No crystal ball could have predicted last year’s shocks in the treasury and the effect that they would have had on our currency, and even the most knowledgeable of investors wouldn’t be able to offer you any predictions of future (in)stability with any sincerity.

It is our view that offshore investing is an important part of any long-term diversification strategy. By investing offshore you diversify your risk across different economies and geographic regions increasing your potential to earn returns from a wider set of opportunities and circumstances. This is why we always work to have offshore exposure in all of our Southern Charter funds, mitigating risk and increasing our opportunities to maximise growth from a diversity of possible outcomes.

Rather than asking 'when' to go offshore, consider where, how and how much. The amount that you decide to take offshore should be based on your investment objectives, age, risk tolerance and personal circumstances. With so many offshore opportunities available, from emerging markets to the more advanced to local funds with offshore exposure, the trick is finding the right offshore investment solution for you.

Contact your wealth manager or financial advisor for more information, and some help with finding the right answers to the right questions.