John C. Bogle at the CFA Conference

One of the talks I’d been most looking forward to at this year’s CFA Conference was John C. Bogle, Founder of the Vanguard Group and one of the most prolific practitioners at this year’s event exploring “A New Era for Finance and Financial Markets”.

No stranger to disruptive innovation Jack Bogle, as he is affectionately known, is the founder and former CEO of the Vanguard Group currently serving as the President of the Bogle Financial Markets Research Centre. Throughout his long career, 88 year old Bogle has been awarded numerous accolades including the CFA Institute Award for Professional Excellence; the Woodrow Wilson Award from Princeton; and an induction into the Fixed Income Analysts Society Hall of Fame. With his degree in Economics from Princeton, Bogle is also the proud holder of 14 honorary doctorates from universities around the world.

He first rose quickly through the ranks of investment management firm Wellington, with his manager at the time noting that “Bogle knows more about the fund business than we do”. Despite his early success, soon becoming Chairman of Wellington, Bogle was fired for a poor merger decision he attributes to the overconfidence of youth. As has been a recurring pattern throughout his life, after every adversity Bogle has bounced back stronger than before going on to found the Vanguard Group, one of the most influential investment companies of our lifetime. He has recently been named as one of the four most influential investment giants of the 20th century by Fortune Magazine and is listed as one of Time’s 100 most influential people.

Bogle is most famous for being the creator and founder of the Vanguard 500 index, the first index mutual fund made available to the public as of 1975 and Vanguard’s flagship fund. His innovative idea was, instead of beating the index and charging management fees, to create an index fund that would mimic the performance of the US stock market over the long-run thus achieving higher returns with lower costs, at ‘lower risks’, than those (often unwarrantedly) attributed to actively managed funds. That said, however, Bogle doesn’t believe that active management is going to ‘disappear’.

It is Vanguard’s ‘bare bones’ structure that allows for their low management fee of 0.12%, which many investors take to be the defining metric and motivation for choosing indexes over active. It is important to note that such a skeletal structure comes with inherent trade-offs and, in fact, higher risk. Vanguard 500 investors are offered no diversification across asset classes or economies, pegging their hopes solely on the performance of the 500 biggest publically traded stocks on the US market. Furthermore, there is no active risk management. Should the US economy collapse or stagnate tomorrow, so would the entirety of your Vanguard 500 portfolio. There is also no ‘ESG’ – or environmental, social or governmental – investment opportunity. The growth of the index is essentially tied to the growth of the US GDP.

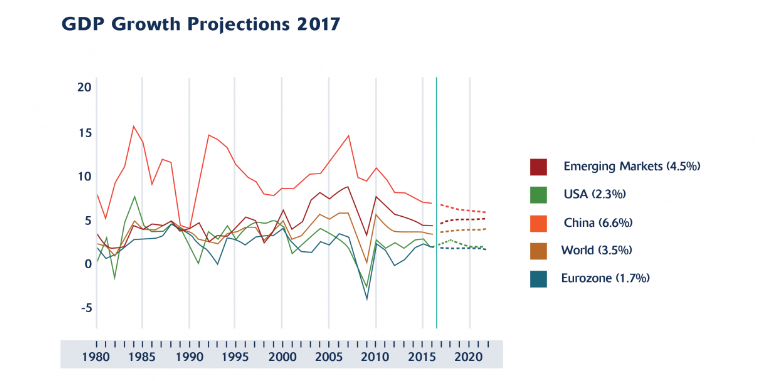

Starting to assert their dominance in 1997, by 2007 indexes had outstripped active asset managers by 1.7 trillion AUM, entering 2017 a considerable 5.6 trillion dollars ahead of active managers. While Vanguard and Bogle attribute lower risks to indexes than active management, the contrary in fact shows itself to be plainly true. This is particularly so at a time like the present with the 9 year bull run in US markets reaching heights we’ve only seen before prior to the great depression and bursting of the dot com bubble. This makes the risks to index-first, or index-only, investors all the more apparent. While they’ve had an incredible run – facilitated by what can be considered a somewhat artificial environment over the last decade - as we know all too well, what goes up must come down. Active managers play an important role in realising value in uncertain and risky markets with more control, flexibility, risk management and diversification than indexes offer.

While we have retained high exposure to the Vanguard 500 over the last few years maximising the benefits of this bull run – with this, in fact, forming the cornerstone of our foreign portfolio - this is one of the reasons why we have significantly reduced our exposure this year. This is the key advantage to active management. While we’ve ridden the wave and enjoyed the ride, as long-term investors the risk of retaining high exposure to the index has begun to outweigh the benefits and we’ve made the strategic choice to instead diversify our risk and seek returns from active stock pickers finding value in emerging markets. This is something the indexes just can’t offer, and what we believe will be to the peril of their investors.

The past 9 years have been a period defined by what many call the “index fund revolution” and what I like to describe as “index nirvana”. Quantitative easing has provided liquidity and a low volatility environment that has allowed indexes to grow exponentially, along with inflated stock prices. Essentially, we have been in an environment of central bank funded growth with central bankers purchasing governmental and other securities in order to drive down interest rates and increase liquidity.

With the Fed - and other central banks in developed economies across the Eurozone and Japan, for example - implementing numerous rounds of QE since the 2007-2008 crash, the long-term effects of this unconventional monetary policy remain to be seen. Most importantly, with the QE era ending at present, how the markets will deal with the withdrawal and ramifications of central bank funded growth, and how they plan on controlling high levels of inflation which runs the risk of choking whatever recovery has been made, is a key area of concern.

As the 9 year bull run reaches near unprecedented heights, the concentration of risk has also increased dramatically between these three managers, an important consideration in any investment decision. This is another of the reasons that we have chosen to lessen our index exposure as of the beginning of 2017.

As Bogle also notes, we’re increasingly operating in a ‘shrinking’ investment universe. Pointing to the Wilshire 5000 he notes that the number of publically traded stocks has fallen from its peak of 7459 in 2000 to a considerably lower 3599 in 2017. Essentially, since 1997, the number of public stocks in the US is down a staggering 52% as the investment industry certainly enters into a ‘new era’. As the ‘investment universe’ – and the building blocks of indexes – shrink while uncertainty rises, active managers offer a safeguard in uncertain times and the opportunity to realise well-diversified, risk-managed returns.

With one of the most prominent debates at this year’s conference being whether or not the S&P is currently overvalued, the performance of the US stock market over the next 10 years could prove to be a significant moment in the history of indexes. In fact, as of late, Bogle himself has admitted that he doesn’t “feel super confident in the stock market. By any historical standards, it’s pretty full valued.” As he has similarly noted, on more than one occasion, “when reward is at its pinnacle, risk is near at hand”. It is this risk that active managers play an invaluable role in mitigating in such times of market and political instability.

On the local front, we make the strategic choice to buy into South African indexes in those cases where we are certain that fund managers can’t beat the index. Our local property portfolio is the perfect example of this. Our index environment, however, is entirely different to that in the US and it is important that all investors are plainly aware of this.

While the passive vs. active management debate is all too often construed to be a low-cost vs. high cost choice, in South Africa any fund manager worthy of the name is able to beat the local Allshare index. All of our Southern Charter funds have since the date of their inception.

All in all, there are many reasons to be cautious of index funds, whether in the US or South Africa and investors need to be entirely clear and comfortable with exactly what they are getting for these bare bones models and low costs. As we see in the US and SA, all too often it can be high risk or significant underperformance.