Key tax deadline dates for the year ended 28 February 2018

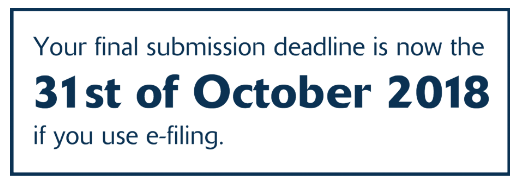

The 2018 tax season opened on the first of July. This means that, if you have not submitted your tax return yet, you have from now until your new deadline to do so.

You do not need to submit a return if:

Your total gross income is less than or equal to R350 000.00 for the tax year; and

you only received income from one employer; and

you have no other income or employment related allowances; and

you are not claiming any tax related deductions such as medical expenses and retirement.

Are you a non-provisional taxpayer?

Most people who receive a regular monthly salary, and no other income, are non-provisional taxpayers.

You have probably heard that there are some changes to the deadlines regarding tax season. SARS has decided to shorten the window that you are able to submit your return by three weeks.

If you want to submit your return through other methods besides e-filing, take a look at the deadlines here.

Are you a provisional taxpayer?

People who receive a regular salary, and additional income from other sources like interest, rental income and commission, are typically provisional taxpayers.

If it is unlikely that you will submit your final tax return before 31 January 2019, and If you want to make a top up provisional tax payment, your deadline to do this is 28th of September 2018.

If you want to submit your return through other methods besides e-filing, take a look at the deadlines here.

Tax tips

Submit returns as soon as possible for certainty and early refund settlement.

Ensure all tax certificates and supporting documents are on file in order to avoid stress and to ensure prompt and accurate response to a SARS request for supporting documents.

If you are struggling with your returns, or just need advice on what to do next, get in touch with our tax department