Insights from international thought leaders, and why we've gone defensive

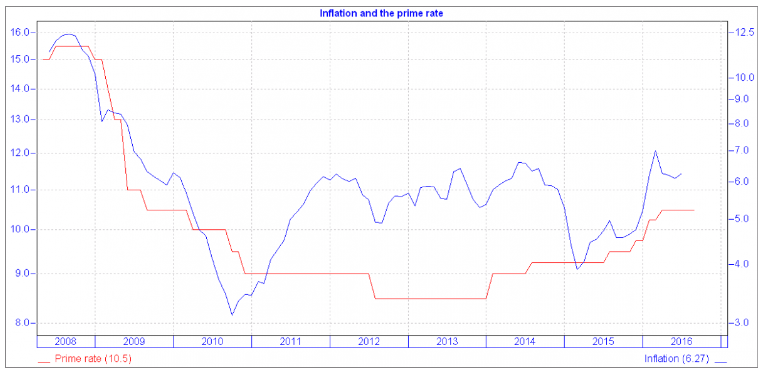

In recent weeks, the outlook for interest rates has improved significantly and further rate hikes could be on hold. This is a big swing since the last MPC (Monetary Policy Committee) meeting in March where the probability for further rate hikes was put at 80%. This has now dropped to 50%.

So what has changed?

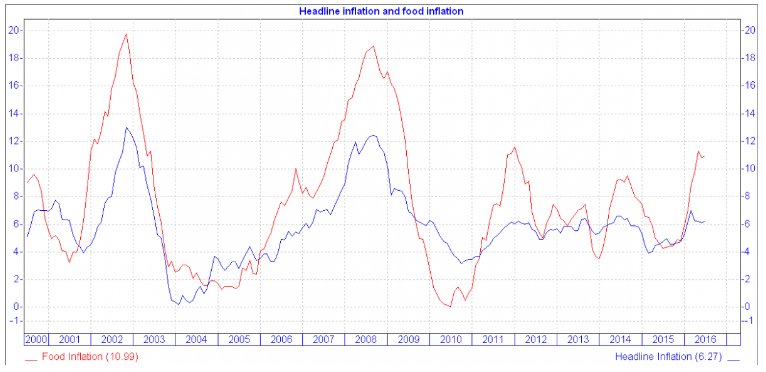

Firstly, the path for inflation has improved with inflation now easing to 6.3% from its peak of 7% in February 2016. This jump in inflation was primarily driven by food inflation rising to 11.3% from the low of 4.3% in July last year. Food inflation has now started to ease as the impact of the drought has softened following recent rainfalls. In addition, international maize prices have fallen keeping the costs of our maize imports down.

Inflation has reached its peak

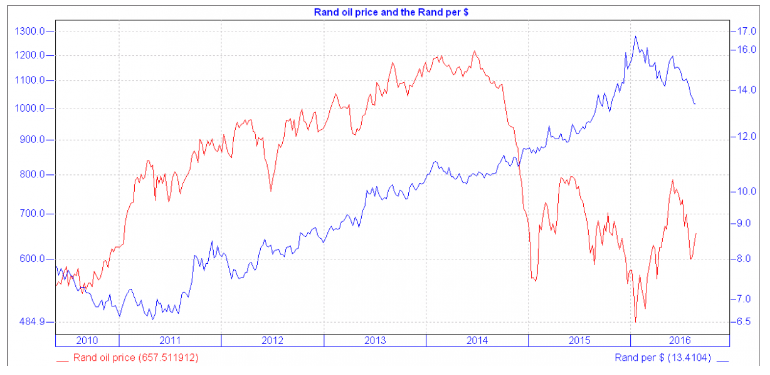

The drop in the oil price from its recent high of $50 down to $43 has also eased pressure on this front. This, together with the 26% appreciation in the Rand since December, has pushed the Rand oil price down 25%. This has already resulted in petrol price cuts. Further cuts are on the cards given the surplus on the stabilisation account. This is all good news for the consumer!

The appreciation in the Rand is not only reflected in lower petrol prices but also in lower imported inflation across a range of goods. With inflation expectations now falling, the Reserve Bank’s inflation target of 3-6% is very much in range. The firmer Rand has also alleviated pressure on the Reserve Bank to hike rates in order to protect the currency.

Rand oil price, and rand per Dollar

Overall, economic fundamentals are looking a bit more positive for the economy with both manufacturing and mining improving as strike activity has eased off and there has been no load shedding in over a year. The outcome of the local elections is a very positive surprise and should improve both consumer and business confidence. Thankfully a recession should be avoided. Nevertheless, growth will be weak at around 0.7% this year, picking up to 1.4% for next year.

Interest rate outlook has improved

The one risk that is still hanging over the economy and interest rates remains the possible debt downgrade in December. On the plud side, some progress is being made in controlling the budget deficit. VAT, personal income tax collections and tightening control on government expenditure have resulted in improvements beyond initial budget targets. We have had a positive and peaceful election and the interest rate and growth outlook have also improved.

On the downside, however, the rating agencies are looking for demonstrable progress on parastatals, like South African Airways (SAA) and Denel, as well as on labour regulation by, for example, legalising a secret ballot for strikes. The implementation of a clear growth strategy like the National Development Plan (NDP) is also being closely monitored.

So, the verdict remains out and December could prove to be a watershed both for the Rand and interest rates. For now, however, the outlook for the rainbow nation seems a little brighter.