Economic Update

We remain cautious and committed to our planned diversified risk profiled asset allocation strategy. Our investment team continues to consult widely with our asset managers, review our independent international macro-economic reports (BCA and JP Morgan) and local fund manager reports, and read widely at this time. We have summarized the key investment themes below;

Global Themes

Markets deliver a strong recovery despite a deep global recession

Green shoots of economic hope emerge late in the quarter

Interest rates remain low for the foreseeable future

Commodities rally as China recovers

Local Themes

Market recovery has been swift despite a deep recession

Fiscal stimulus and continued easy monetary policy

Bonds stage a large rally

An interim Covid19 Special budget was announced

The Rand firmed in line with other emerging markets

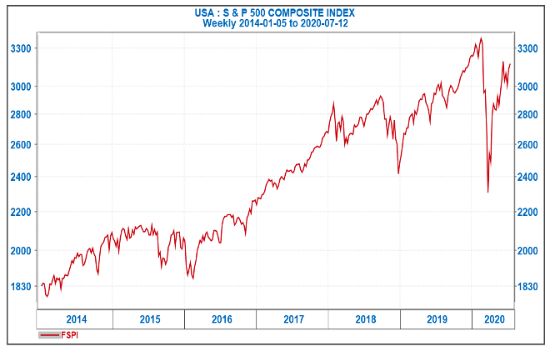

Markets deliver a strong recovery despite a deep global recession.

Graph shows the weekly return of the S&P 500 index having recovered to just under 300 point less than its pre-COVID-19 levels

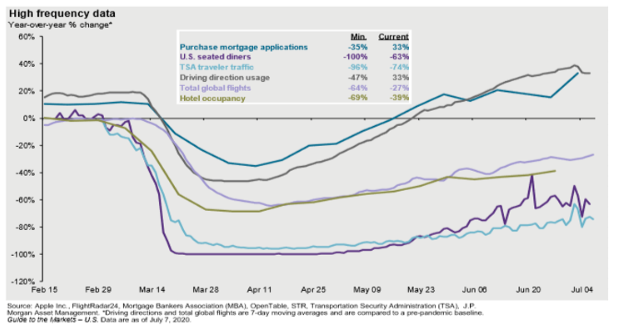

Green shoots of economic hope emerge late in the quarter.

Graph from JP Morgan shows high frequency activity data that act as good leading indicators to more robust measures of the economy.

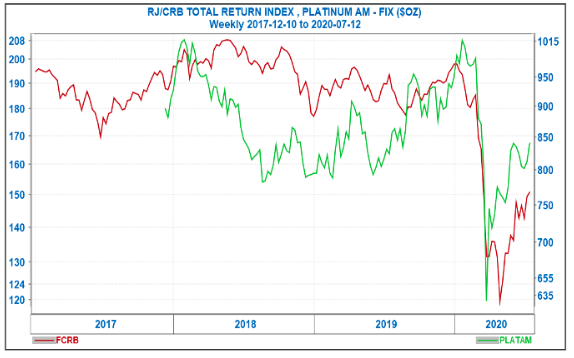

Commodities rally as China recovers

Graph shows Commodity Research Beurre index (red) and Platinum price (green) making a strong recovery in Q2 of 2020

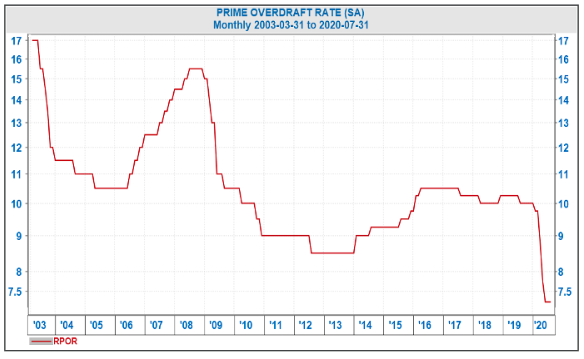

Fiscal stimulus and continued easy monetary policy

Graph shows prime interest rate over time with aggressive 2009 style cut.

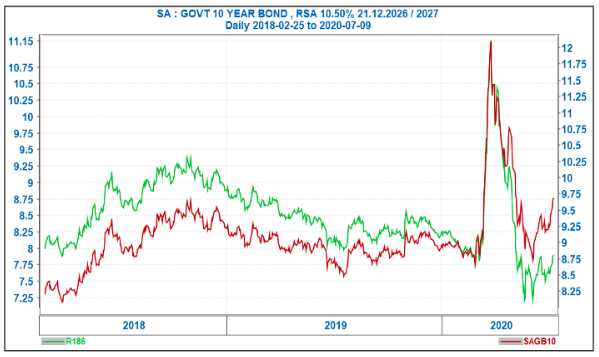

Bonds stage a large rally

Graph shows two SA government bonds yields. The bond yields are attractive at their current levels.

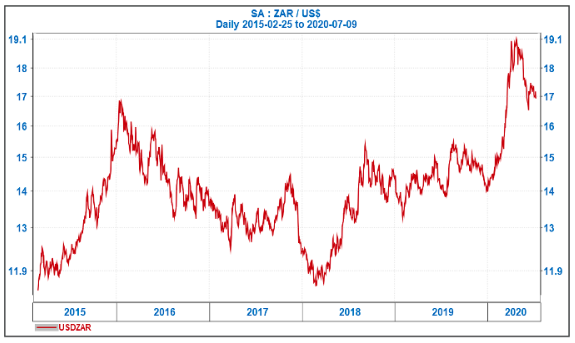

The Rand firmed in line with other emerging markets

Graph show the Rand vs the US dollar over time. The rand has recovered significantly in Q2 of 2020.