Insights from international thought leaders, and why we've gone defensive

In these uncertain times, sometimes we must admit: we know enough to know that we don’t know everything. While it may seem counter-intuitive, it is a very important and unique position to take in our field.

It is also the very same multi-award winning philosophy which underpinned our thinking during the 2007/2008 financial crisis in which our funds outperformed all others in South Africa during some of the most volatile times modern markets have seen. While this may not be a repeat of the financial crisis, our thinking has remained unchanged.

So, we’ve consulted a diverse range of some of the most knowledgeable people in investments today, locally and internationally, to ensure that we protect and grow your investments to the very highest global standards throughout this period.

Over the last two months we have attended 60 investment presentations. I attended 17 over four days in Montreal, Canada, at the Certified Financial Analysts’ (CFA) Annual Investment Conference, and one in London where I met with Investec in order to discuss our Fixed Interest Portfolio.

On the local front, I have recently met personally with Allan Gray and Prudential to discuss our investments and thinking going forward. Additionally, we have also attended a two day investment conference where each of the leading fund managers by asset class in South Africa had 15 minutes to share their differentiating investment views.

Over the next three months I’ll be posting a series of articles which explain what exactly we have taken out of each of these conversations, and how that has informed our investment philosophy for the coming months, in a little more depth. Keep an eye on our Southern Charter blog to ensure that you’re up to date with all of our current strategic thinking and the latest international investment insights.

In synopsis, however, we have concluded the following:

Investment Strategy

With the current levels of uncertainty, it would be prudent to be more cautious and defensive rather than growth-orientated during this period of change.

Fixed interest, as an asset class, is producing almost zero return and alternative investments need to be made.

Oil and energy may peak sooner than we think.

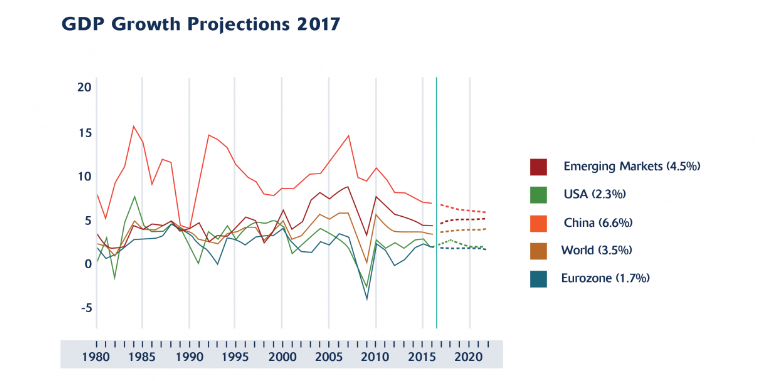

How China manages its debt and declining currency is the biggest risk to global financial stability.

Actions

We have taken the following actions in order to reduce the risk in your investment portfolio considerably.

We have sold out of all of the fixed income funds and moved to Investec’s low-volatility, low-risk, multi-asset class income fund targeting 4% in US$ terms.

We have reduced our exposure to risk in fairly priced to over-priced developed markets where we see more downside risk than upside risk. We have done so by as much as 50% in the United States (US), and have sold our stakes in the Chindia Fund and Orbis Japan funds completely. This represents up to 24% of the portfolio which is now held in cash.

The Plan

Our plan is to hold onto cash during this time of volatility and uncertainty defined by recent and upcoming events such as the UK’s Brexit referendum, the heated US presidential elections and the potential rate increase.

We plan to buy back into the market weaknesses as they present. We also intend to buy value-driven stock picker fund managers, which represents a more defensive strategy.

All of the above actions are designed to protect wealth and to be defensive. While we always work to grow your investments to the best of our ability, as we will continue to do, what many investment managers may not admit is that wealth protection is an equally important part of that strategy. It is something that we take very seriously here at Southern Charter.

Our unconstrained strategic thinking ensures that you are protected for any and every eventuality and, as opportunities for growth present themselves going forward, we’ll buy back into these maximising the opportunities sure to emerge after this period of international financial prudence.

Please feel free to contact your financial advisor or wealth manager, as usual, should you like a little more detail into how these investment decisions concern and are designed to protect you and your investment personally.

Mark Thompson

Southern Charter CEO