Commodities - An Oversold Rebound or Cyclical Rally?

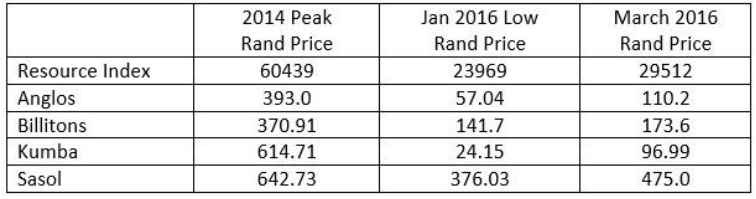

Recent weeks have witnessed a strong rally in the resources sector with the index up 38% from its 10-year low in January. This follows a 61% drop from August 2014 when a strong Dollar, slowing Chinese growth, and excess supply all created a perfectly bad storm for commodities.

The rebound has been swift and some of the major stocks, such as Kumba and Anglo, have had impressive rallies. Some of this has been triggered by hedge fund managers being caught short as well as many 'long-only' managers having been on the sidelines, waiting for clear earnings revisions to come through before buying.

Resource shares have been volatile

The question now is… Is this the start of a bull market in resources, or is this simply a bounce likely to run out of steam soon?

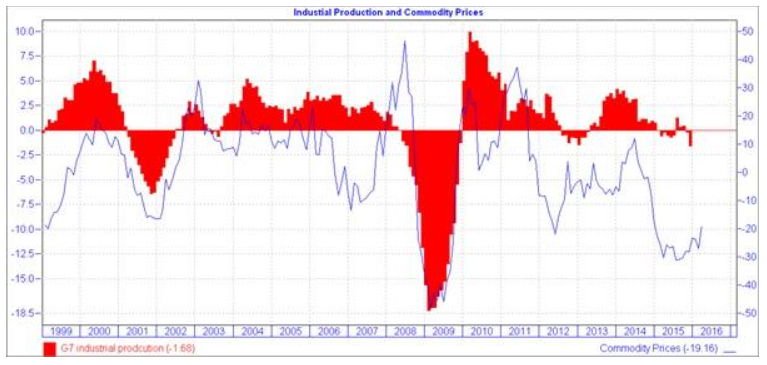

When looking at the fundamentals there have not been any significant changes. In fact, manufacturing trends in China and many other countries all still point to a contraction. Despite this, some of the major commodity prices such as copper and iron-ore have improved. This could be due to short covering rather than a change in supply-demand fundamentals, and an improvement in sentiment around China given recent policy measures.

G7 industrial production is still weak

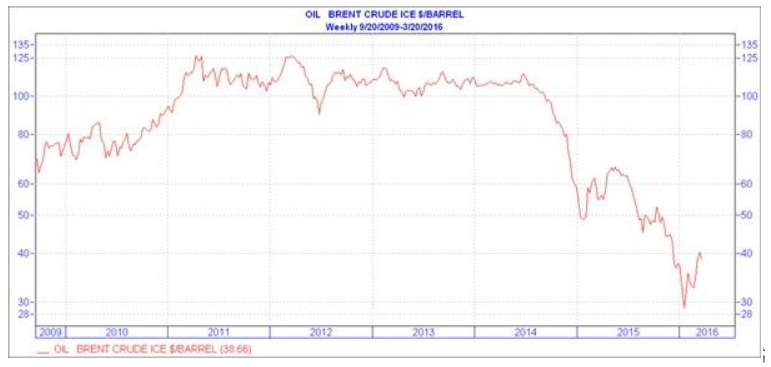

The more sustainable recovery has been in the oil price which has risen from its low of $27 to $40 on the back of January production freezes by Saudi Arabia and Russia. A drop-off in shale gas production has also helped. Saudi Arabia’s balancing act of increasing market share vs. destroying one’s revenue base remains a challenge. Their dilemma is that, if they allow the oil price to firm to support oil revenues, shale gas supply will again come back onto the market at some point. This clearly puts a lid on the oil price recovery unless Saudi Arabia and other Opec members abandon their market share war and curtail supply.

Brent crude oil price

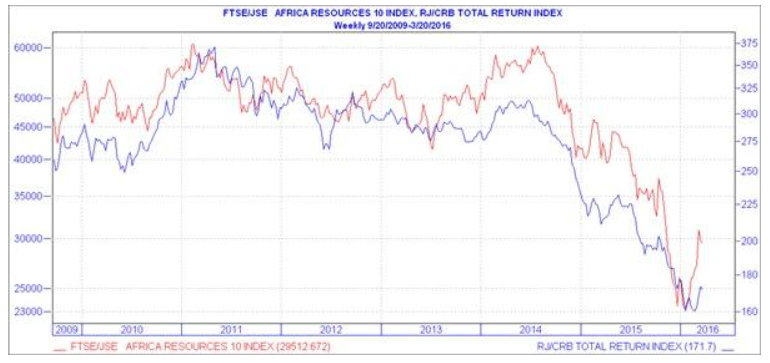

There is no scientific method to know how durable this rally is but one must also be cognisant that the market is a discounting mechanism assessing what is coming in the future. Sometimes it's early, sometimes it's wrong, and sometimes it's right.

The key to the sustainability of this recovery depends on earnings and profit margins improving in coming months. For this to occur commodity prices will need to recover on a sustained basis which, given the global manufacturing outlook, seems unlikely. At some point, however, the world of negative nominal interest rates in most of the developed world (except for the US), massive QE programmes, and stimulus packages in China and Japan must stimulate growth.

Resource Index has had a bounce

Consequently, we have added to resources in our local funds but have done so fairly cautiously as we are very conscious of the volatility that this could add to investment returns.