2016 Investment Outlook

We've taken a look at the global investment outlook for the year ahead. Read below to explore the thinking that'll be underpinning our investment decisions in 2016.

Themes for 2016

A muted global business cycle

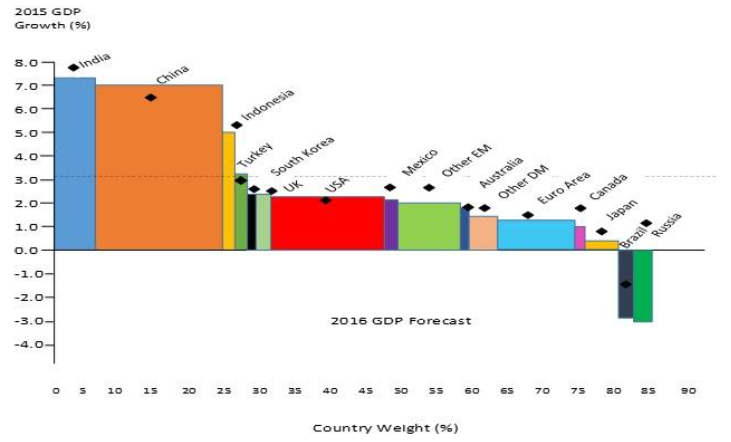

The expected growth benefit of low oil prices has failed to materialise as global consumers continue to consolidate debt. Despite this, global growth is expected to reach 3.6% for 2016 - up from 3.3% - as developed economies recover. The global business cycle is diverging from manufacturing in developed countries, while services – which make up two thirds of these economies - are growing. Developed markets will expand modestly, while emerging markets will continue to suffer from the Chinese fallout and structural adjustments as capital flows out of these markets.

Growth forecasts for 2016 and country weights

US growth remains intact, but there are challenges

Despite the 2.3% growth expected in the US for this year, challenges remain as the ISM manufacturing index has fallen below 50 for the last two months indicating a contraction in that sector. This reflects both the strong dollar, and a shrinking oil industry. On the labour front, the unemployment rate has halved to 5% but wage growth remains muted. The Fed continues to face a few challenges and therefore a cautious interest rate cycle is expected, with rates only likely to reach 1% by the end of 2016, which is up from 0.5% at present.

The Eurozone is in a modest recovery

The Eurozone is in a modest recovery supported by low interest rates, QE and a weak Euro. However, inflation remains very low at 0.2% and export revival remains at risk from the Chinese slowdown. With Mario Draghi introducing negative deposit rates (-0.3%) and QE being extended to March 2017, he is doing “everything it takes” to avoid deflation and stimulate growth. Growth could reach 1.7% for the year, up from 1.5%.

Japan is running out of steam

Japan seems to be running out of steam with two quarters of contraction and growth of only 0.9% expected, which is up slightly from 0.6% last year. Although “Abenomics” seems to be faltering, further QE and a weak Yen can be expected as deflation is once again on the horizon.

China’s growth transition continues

China’s transition from infrastructure-led growth to more consumer/services-led growth is set to continue with consumer spending expected to grow 8.4% while capex spending is to drop by 5.6%. This will bring growth down to 6.3% in 2016 from 6.9%. None of this bodes well for commodities. Beijing's perceived shaky grip on economic policy is at the top of investors' concerns for 2016 after falls in its stock markets and the Yuan have raised concerns that the economy may be rapidly deteriorating.

Policymakers will remain challenged

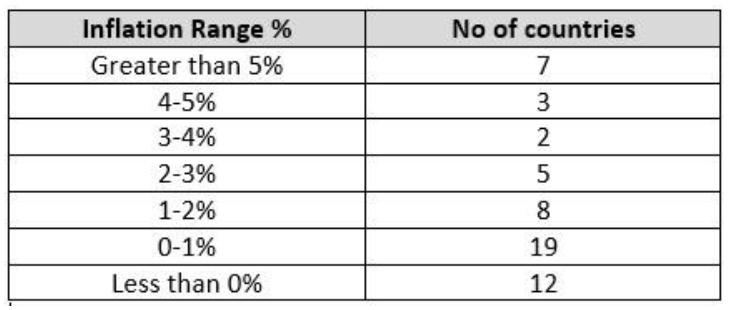

The $80 drop in the oil price has raised the risk of deflation. 31 out of 56 countries currently have inflation below 1%, and 12 countries have inflation rates of less than 0%. Avoiding deflation and stimulating growth will remain policymakers' biggest challenge in the face of muted demand and oil prices below $30. Having gone to the extremes on monetary policy with questionable success, fiscal policy is the only tool still available. Given the political challenges of managing budget deficits, however, policymakers are still reluctant to use government spending to stimulate growth. As such, a world of low interest rates is here for some time with long rates being anchored by low inflation and short rates by the need to stimulate. Against this background, fixed interest returns will remain poor.

Low inflation is very prevalent

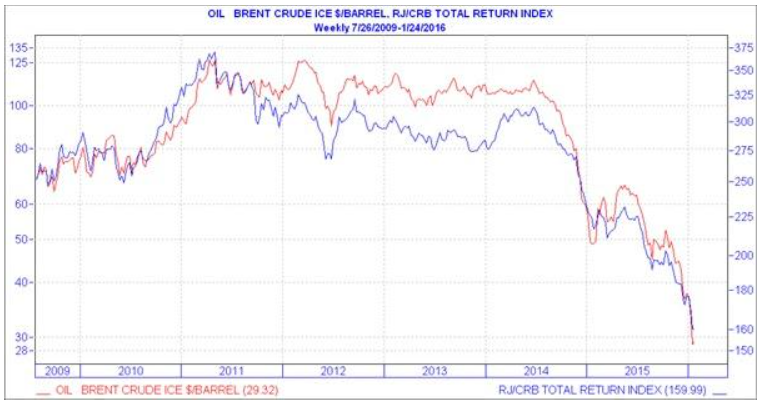

The commodity bear remains alive

Commodities prices will remain under pressure as the dollar remains firm and Chinese investment spending falls by 5.6% this year. Commodity prices are at multi-year lows, but the catalyst of contracting supply is not on the horizon yet so expect more pain. Too many companies are still trying to protect revenue streams by increasing production. Pressure will remain on resource companies as they adjust earnings expectations in line with lower spot prices.

The commodity bear market is intact

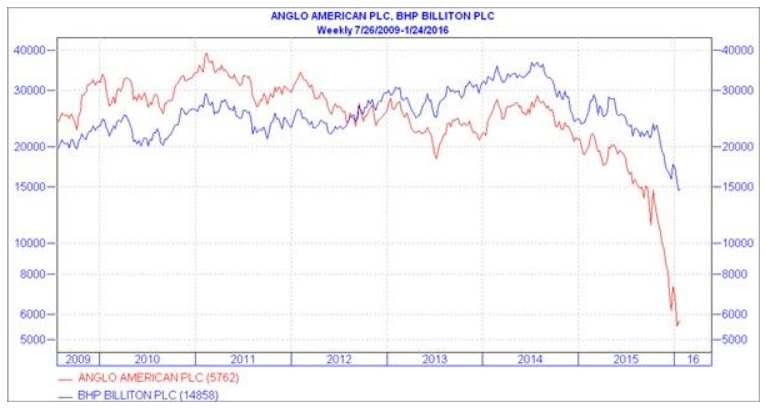

Low oil prices to provide a double-edged sword

Low oil prices remain a double-edged sword, being positive for oil importers and consumers but negative for oil producers and some parts of the investment market. The impact has been felt in the high yield debt market with yields jumping as the default risk for oil companies rises with falling oil prices. Equity markets have also seen massive corrections in companies like Anglo and Billiton which have fallen by 80% and 60% respectively. The impact on the market is being further exacerbated by major oil-producing countries starting to liquidate parts of their large sovereign wealth funds in order to meet budget constraints.

Big falls in Anglo and Billiton

Local challenges are set to continue

Growth gets weaker

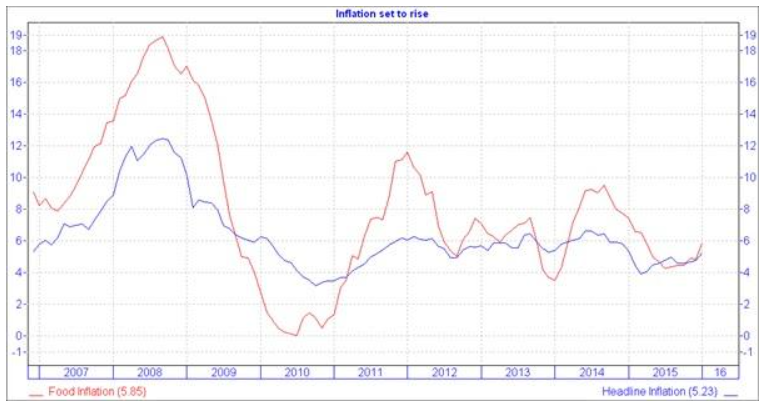

The IMF has downgraded the South African growth outlook from 1.4% to 0.7%. Our growth outlook has been hurt by a further loss of confidence, the impact of the severe drought in most parts of the country, low commodity prices and weak exports. Rising inflation and rising interest rates Inflation, now at 5.2%, is set to breach the 6% upper-end of the inflation target range as the impact of the worst drought since 1992 is felt. Maize prices are already up 40% and 6 million tons of maize need to be imported to meet 50% of our maize demand. Reflecting this, cereal inflation has already jumped to 42%. Food inflation, now at 5.8%, could well rise to at least 15%. In the last severe drought in 1992, food inflation rose rapidly from 16.5% to 30%. Food is 14.2% in the inflation basket and therefore the impact of this on headline inflation will be large, pushing the average inflation rate to 6.4% for the year.

The effect of the weaker Rand and higher electricity prices will also come through. Given the expectation of higher inflation and the continued weak Eand, the Reserve Bank will most likely hike rates more aggressively now and the Repo rate and Prime rate could end up at 7.50% and 11.0% respectively by the end of 2016 - a total of 125 basis points increase in 2016.

Inflation is under pressure

The Rand outlook remains poor

Despite the massive depreciation in the currency, the Rand will remain under pressure as long as there is a looming possibility of a debt downgrade to junk status. In this regard, the February budget will be closely watched by the rating agencies. If little progress is made on keeping the budget deficit of 3.8% under control, the risks increase. In addition, the outlook for emerging markets is not positive and as such, capital will continue to flow out as investors become risk averse, further weakening our balance of payments.

Rand weakness to continue

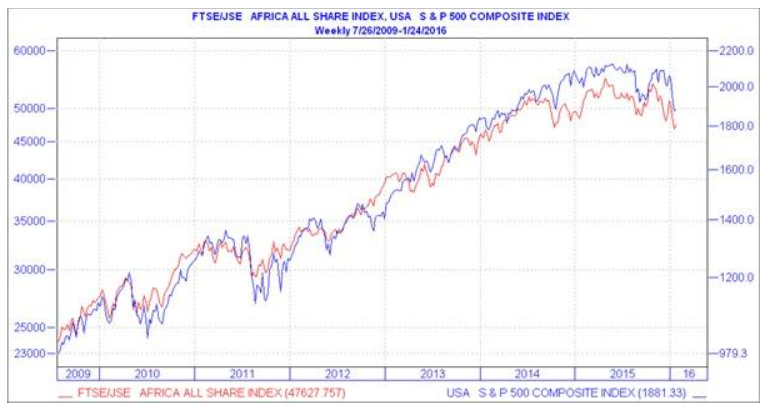

Investment returns to remain volatile and muted

The investment environment remains challenging and, given that we are in a mature bull market, valuations aren’t cheap, earnings could disappoint, and equity returns are expected to be modest. Not only that, stock-picking will be key both locally and globally. Cash and fixed interest returns globally will be below 2%. In contrast, local cash returns will improve while the historic stellar returns of local listed property won’t be repeated as bond yields come under pressure from a weak Rand. Offshore assets will significantly outperform local assets on a Rand-adjusted basis. The returns seen over the last 5 years are not likely to be repeated and investors need to lower their expectations accordingly. Portfolio diversification will remain key in this volatile environment and we have positioned our portfolios more defensively to weather the storm. Notwithstanding this, the extent of the correction does seem irrational and within that we will look for opportunities to enhance your long-term wealth creation.

Equity markets to remain volatile